By Cesar López, Sustainable Sanitation Officer, Water For People in Guatemala

Versión en español aquí.

Microcredit in emerging economies is traditionally channeled to the commercial, manufacturing, and service sectors, aimed at unbanked segments of the population. In the last decade, however, financing initiatives aimed at having an impact beyond commercial matters – commonly referred to as green financing – have gained momentum.

Under this premise, microfinance institutions (MFIs) in Latin America, and specifically in Guatemala, have shown greater openness to non-traditional financing initiatives, including low-income housing, solar panels, wood-saving stoves, and sustainable agriculture. We are also beginning to see the emergence of financing for decentralized water and sanitation solutions on a small scale for families without access to dignified and hygienic home solutions.

Taking the first steps

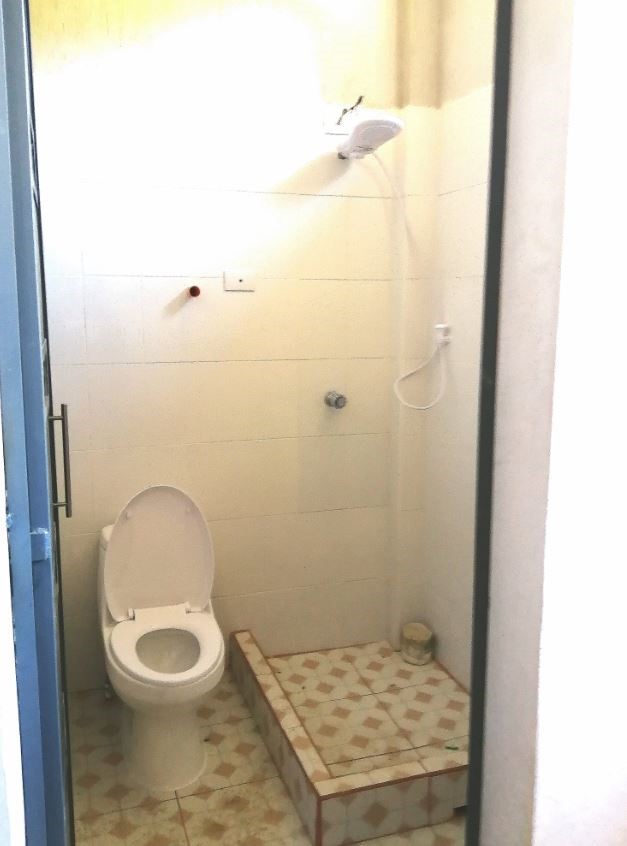

In November 2020, Water For People in Guatemala signed a cooperative agreement with the MFI Foundation for Small Business Advisory (FAPE, for the Spanish acronym) in a district where we do not implement the Everyone Forever model to finance comprehensive solutions for the improvement and installation of hygienic and dignified sanitation units at the household level. This includes the construction and remodeling of bathrooms and attached areas such as the sink and shower, the purchase of water rights, and the drilling of water wells.

The model seeks to demonstrate to the microfinance sector an unserved market niche and impactful financing, contributing directly to the achievement of Sustainable Development Goal (SDG) 6. This is a window of opportunity for the MFI to offer a differentiated product and address the water and sanitation problem from a market perspective.

Why water and sanitation?

Average country-level sanitation coverage in rural areas is low compared to urban areas. According to the population census, 46% of the Guatemalan population lives in rural areas,1 and only 55% of the population has access to urban sewerage. This means that 45% of the total population has issues with access to dignified sanitation,2 highlighting the unaddressed problem. The needs for both water and sanitation as a human right are closely related: in the absence of one, there is scarcity of the other; tackling one only solves part of the problem.

For the MFI, it is more attractive to offer comprehensive solutions based on profitability and a greater range of services. For users, having a financing option for a basic need represents an opportunity for financial inclusion and improving the quality of life for the family that spends time searching for water or a suitable place to perform basic needs. The on-site verification of the financing granted by the MFI shows the sector challenges in the served areas.

| No. of credits (4 months) | Total amount | Average |

| 45 | $21,230 | $471 |

Of 45 loans granted from November 2020 to March 2021, a sampling of users showed that the loans were used to build bathrooms, remodel, and connect to drains; in other cases, they were to drill water wells, influenced by the scarcity of water in gravity systems due to the indiscriminate felling of forests that contain water sources, and the little to no management of an integrated water resources management plan by the competent authorities.

Could this be an option for scaling water and sanitation with a market focus?

Scaling up water, sanitation, and hygiene initiatives represents a challenge due to the low priority given to this sector by governments. Therefore, the involvement of the private sector is an alternative mechanism with the ingredients of sustainability in terms of access and coverage. It is not subsidized, as the issue has traditionally been addressed.

As a financing alternative, the user solves their problem with their own means, guaranteeing continuity of service at the household level and establishing an intangible asset that they must care for.

The MFI can be the window of opportunity for the microfinance sector to venture into water and sanitation in other regions of the country and replicate these best practices through various service channels and promotional means to offer comprehensive solutions for the poorest families of the rural countryside.